Business Services

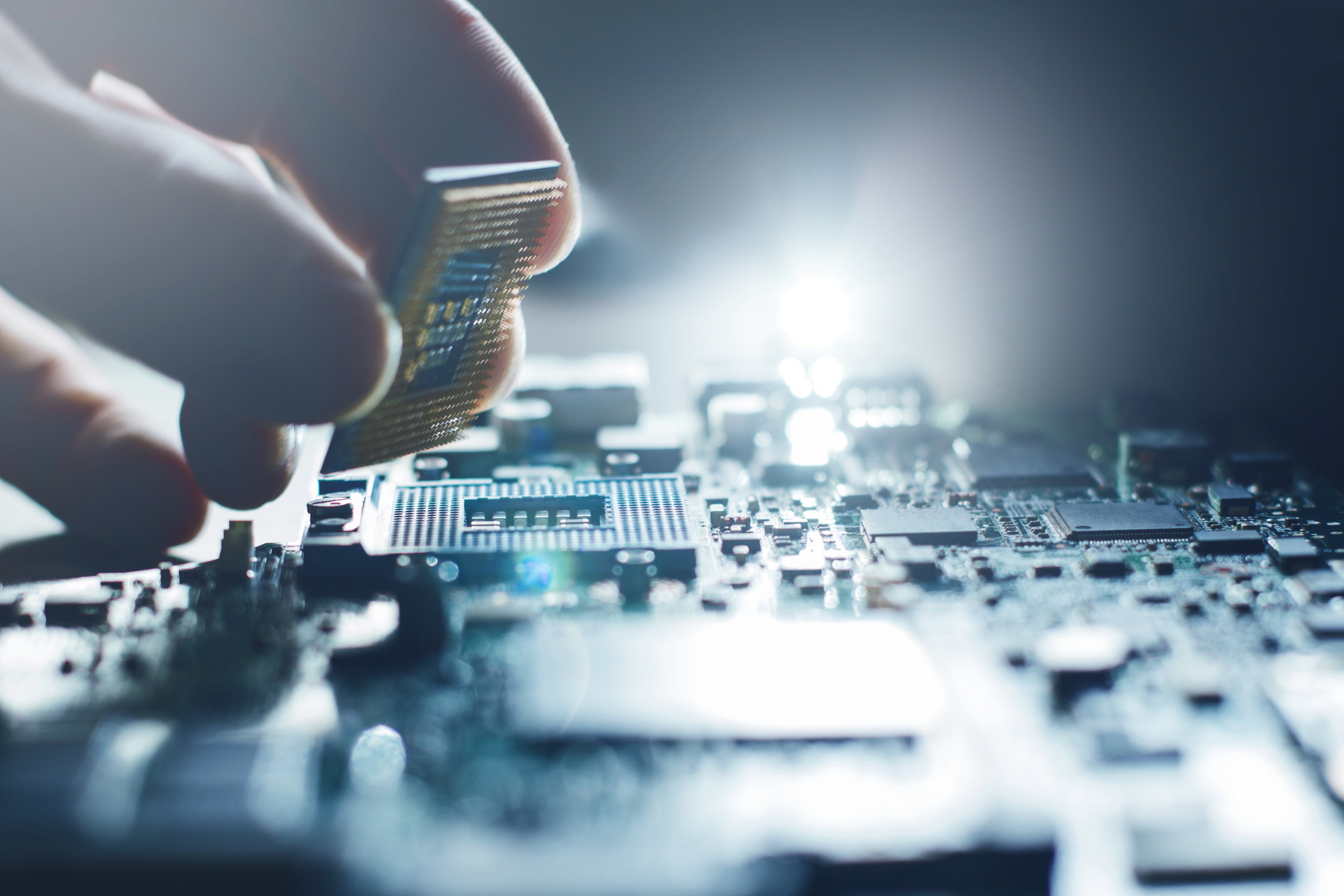

MicroEd have staff dedicated to servicing business through our Professional Services division.

MicroEd Computers is your one stop solution provider for all your Computer and IT needs.

Established in 1984 and located in Caboolture, MicroEd offers New Computer Sales, Computer Upgrades, Servers, Networking, IT Support, Managed Services, Service Level Agreements, Computer Repairs & Solutions, Phone Systems and Professional Advice. Call us now on 07 54990822 or come in and talk to our friendly qualified staff.

When it comes to computer servicing and repairs our technicians have a vast range of experience. We solve all types of problems on a daily basis. MicroEd is well known in the area for its friendly service and Quick Turn-Around time.

Call us or submit a support ticket for phone tech support.

Contact us and book one of our friendly technicians for an on-site visit.

MicroED has assisted our business for the last 18 months and we are extremely happy with their service. Glenn and the team have provided professional and prompt assistance when we've needed them most.

Thank you Glenn and the MicroEd team. You make the ongoing challenge of I.T. a manageable task rather than a constant head-ache. Its a pleasure to deal with friendly and reliable professionals who help us achieve the I.T. outcomes necessary... read moreThank you Glenn and the MicroEd team. You make the ongoing challenge of I.T. a manageable task rather than a constant head-ache. Its a pleasure to deal with friendly and reliable professionals who help us achieve the I.T. outcomes necessary to serve our clients more efficiently and effectively. read less

We started using Glenn and his team at Microed when one of our suppliers recommended we give them a try. Since then we have valued their reliable service and advice especially their recommendation of late to introduce office 365. The... read moreWe started using Glenn and his team at Microed when one of our suppliers recommended we give them a try. Since then we have valued their reliable service and advice especially their recommendation of late to introduce office 365. The introduction of this software has allowed us to keep in touch with all aspects of our business while out on site thus giving us the ability to provide better service in a more efficient and productive way. Also we feel confident we can rely on Microed to take care of all our IT requirements leaving us free to concentrate on other aspects of our business. read less

I cant recommend Glen & his team highly enough. My business relies on my computers, and if there is a problem, MicroEd are prompt with their assistance.

I cant recommend Glen & his team highly enough. My business relies on my computers, and if there is a problem, MicroEd are prompt with their assistance.

Thank you so much the friendly team at MicroEd. I am self employed and on a modest income, the team at MicroEd treated me as if I was their number one client. I received friendly and professional service when I... read moreThank you so much the friendly team at MicroEd. I am self employed and on a modest income, the team at MicroEd treated me as if I was their number one client. I received friendly and professional service when I needed to replace my laptop and also thank you so much Chris Challen for recovering all the data I had thought to be lost read less

We approached MicroEd to assist us with the upgrade of our business technology. Our company needed someone who was straight talking and had the ability to be there when we needed them as we had many troubles in the past... read moreWe approached MicroEd to assist us with the upgrade of our business technology. Our company needed someone who was straight talking and had the ability to be there when we needed them as we had many troubles in the past with other contractors. We have never regretted making the decision to use this local company to supply all of our computer needs and would not think twice about referring them to any other business. Well done MicroEd keep doing great business read less

Dear Glenn, I have had my computer into your workshop twice in the last couple of weeks. I would like to thank your staff, (especially John, George & Alex, who were the only ones that I have had dealings with)... read moreDear Glenn, I have had my computer into your workshop twice in the last couple of weeks. I would like to thank your staff, (especially John, George & Alex, who were the only ones that I have had dealings with) for the quality of service that they have given me. Their knowledge and understanding of computers is truly amazing & and no problem seems to be beyond their expertise. They are very talented computer gurus. Also, I really appreciate the friendliness, understanding & respect they give to a 75 year old codger like me. I have taken a couple of your business cards & I am handing them out to my computer friends with my recommendation that they use your company for their PC problems. Could you please pass on my appreciation to your staff. read less

The team at MicroEd are super efficient, helpful and professional. They are always very happy to talk you through a technical issue or are very prompt if they need to come to your home or workplace. If there were... read moreThe team at MicroEd are super efficient, helpful and professional. They are always very happy to talk you through a technical issue or are very prompt if they need to come to your home or workplace. If there were more stars we would give them a higher rating!! read less

Glenn and his team are outstanding. Nothing is an issue. Always on hand when I need them. Glenn has spent hours working on software for our OPG machine. Amazing. ... read moreGlenn and his team are outstanding. Nothing is an issue. Always on hand when I need them. Glenn has spent hours working on software for our OPG machine. Amazing. Highly highly recommend. read less

Glenn and his team are outstanding. Nothing is an issue. Always on hand when I need them. Glenn has spent hours working on software for our OPG machine. Amazing. ... read moreGlenn and his team are outstanding. Nothing is an issue. Always on hand when I need them. Glenn has spent hours working on software for our OPG machine. Amazing. Highly highly recommend. read less

So helpful, and experts at thier job

My laptop was very unwell, now it is so much better. Go to the Techs who know what they are talking about.

Good ideas, fast response time, IT expertise and reliability make MicroEd our preferred IT support team. They have designed the Computer infrastructure as our business has grown so that it continues to meet our business needs rather than impeding our... read moreGood ideas, fast response time, IT expertise and reliability make MicroEd our preferred IT support team. They have designed the Computer infrastructure as our business has grown so that it continues to meet our business needs rather than impeding our growth. Very happy to have the support of these guys. read less

Service is not only thorough but friendly. They're not afraid speak up if what you propose is overkill or not compatible with your system rather than just installing whatever you ask thoughtlessly and charging you.

They have a fairly wide variety... read moreService is not only thorough but friendly. They're not afraid speak up if what you propose is overkill or not compatible with your system rather than just installing whatever you ask thoughtlessly and charging you.

They have a fairly wide variety of components and parts and will order in whatever you want if you've got a custom list. They also do builds themselves which is fantastic as they can diagnose issues, clean up your messy cabling and fit parts which they do on the regular.

I've been very happy with their help in diagnosing faults, fitting appropriate replacements and they job they did cleaning up the cabling from my amateur self-build. Communication is excellent to boot. read less

We have found Glenn and MicroEd very experienced, friendly, professional and above all else to provide excellent service. The proactive thinking by their team has resulted in a solution to our I.T. issues that has exceeded all of our expectations.... read moreWe have found Glenn and MicroEd very experienced, friendly, professional and above all else to provide excellent service. The proactive thinking by their team has resulted in a solution to our I.T. issues that has exceeded all of our expectations. We have no hesitation in recommending Glenn and the team at MicroEd to others looking for tailored it solutions and advice. read less

The MicroEd team have always shown great professionalism and demonstrated knowledge and understanding of our individual computing needs. The tireless efforts of Glenn and Duane are always much appreciated as over the past eighteen months we have updated our website... read moreThe MicroEd team have always shown great professionalism and demonstrated knowledge and understanding of our individual computing needs. The tireless efforts of Glenn and Duane are always much appreciated as over the past eighteen months we have updated our website (a stand out and so user friendly!), upgraded our laptops and server, and improved our wireless connectivity. Thank you for everything -especially for when the gremlins get in! MicroEd are the people to go to for any business needing a great IT team read less

Thank you Glenn for your expert help once again. You are truly amazing. Today when I had a technical problem within no time remotely you had it all fixed for me. Your knowledge and help with all matters is always... read moreThank you Glenn for your expert help once again. You are truly amazing. Today when I had a technical problem within no time remotely you had it all fixed for me. Your knowledge and help with all matters is always so prompt and efficient. You deserve more than the 5 stars. read less

Where do I start. We have been working closely with Glenn and the team at MicroEd since 2009. In this time MicroEd have consistently shown that they really are IT experts.

The ability of their team to... read moreWhere do I start. We have been working closely with Glenn and the team at MicroEd since 2009. In this time MicroEd have consistently shown that they really are IT experts.

The ability of their team to diagnose and rectify any issues is second to none. We also appreciate their understanding of how important all things IT are to our business (and staff sanity).

We highly recommend MicroEd to any business that wants the best. read less

MicroEd are phenomenal! They are so professional, friendly, efficient and knowledgeable. Nothing is ever an issue for them to help with. Highly recommend them to anyone; whether needing their services for business or personal computer and internet needs.

Glenn & his staff have always impressed with their courtesy, dedication, expertise & willingness to help. Glenn has looked after this company for many years and we are happy to recommend him to others.

We chose MicroEd to take care of the website design and IT set up for our new practice. What a great decision!!! Thanks Glenn.

We have utilised the services of MicroEd Computers & Web Services for a range of issues including installation and setting up of new computer systems and the setting up of new Wi-Fi enabled printers.” “MicroEd also host our company’s website... read moreWe have utilised the services of MicroEd Computers & Web Services for a range of issues including installation and setting up of new computer systems and the setting up of new Wi-Fi enabled printers.” “MicroEd also host our company’s website which was originally designed by them. The website has recently undergone a major re-design and upgrade with inclusion of video content and connection to an external database. We cannot understate how impressed we are at the ease of working with Alan Barnes. To say Alan’s service is prompt and efficient does not come near enough. Alan took less time to have any additions/changes made to the site than we took to actually identify them. The result is an extremely professional and communicative website which we are certain will support sales growth.” “Across a broad range of services, we found all MicroEd staff to be at the top of their game. Their knowledge base is impressive and their technical service second to none. Whilst there may be more economical options in the marketplace, after investigation, we decided to remain with MicroEd. Any slight savings in immediate terms cant be matched to the long-term savings of a no down-time, ultra efficient service and peace of mind. The fact that all MicroEd staff are extremely professional, polite and friendly makes them all the more fantastic to work with. We’ll be staying with MicroEd read less

Glenn and his team has helped my business numerous times and I have always had great service. Glenn's depth of knowledge along with his interest in my business needs have helped me streamline my processes through implementing software and hardware... read moreGlenn and his team has helped my business numerous times and I have always had great service. Glenn's depth of knowledge along with his interest in my business needs have helped me streamline my processes through implementing software and hardware solutions that suit my business. The rest of the MicroEd team are also excellent, they always go out of their way to assist. I highly recommend MicroEd for any of your computing needs. read less

3 months ago we engaged Glenn & his team at MicroEd and our experience in this time has been of the highest standard. Glenn is a total professional that has treated our business with a level of dedication and respect... read more3 months ago we engaged Glenn & his team at MicroEd and our experience in this time has been of the highest standard. Glenn is a total professional that has treated our business with a level of dedication and respect that we were sorely lacking from the IT angle. From our first meeting through to the implementation of our server and Office 365, it has been a seamless process without the stress and frustration of our previous setup. We cannot recommend Glenn and his team highly enough, he is an absolute pleasure to deal with and we look forward to our continued association with MicroEd read less

Computer died and needed repair urgently. They were super helpfull and knowledgable and saved the day! Thanks so much guys

We are two retired people who had a meltdown with our computer and so consequently had to buy another. We were referred to your shop on Morayfield Rd, which we did last Saturday the 4th. We met John who proceeded... read moreWe are two retired people who had a meltdown with our computer and so consequently had to buy another. We were referred to your shop on Morayfield Rd, which we did last Saturday the 4th. We met John who proceeded to talk to us about our needs. He was very polite, interested and did not treat us as idiots as a lot of sales people are inclined to do. They seem to think that because the years go on the brain flies out the window. He set us up with exactly what we needed rather than everything he could. Anyway Glenn a great experience and we will certainly be back and send others to you. read less

We have changed software systems and this involved a fair bit of hardware change and upgrade. The MicroEd team, proved to be exceptionally knowledgable in all areas and very keen to have a quick response to queries at all times.We... read moreWe have changed software systems and this involved a fair bit of hardware change and upgrade. The MicroEd team, proved to be exceptionally knowledgable in all areas and very keen to have a quick response to queries at all times.We are located almost 2 hrs from the MicroEd office however I will now not use anyone else for any IT issues as they tend to have the right answer quickly rather than guessing and eventually coming up with a solution. read less

We have found Glenn and staff at MicroEd to be extremely helpful in dealing with our computer problems. Nothing is too much trouble, even the more minor ones we sometimes encounter. We would be lost without them and would recommend... read moreWe have found Glenn and staff at MicroEd to be extremely helpful in dealing with our computer problems. Nothing is too much trouble, even the more minor ones we sometimes encounter. We would be lost without them and would recommend them to anyone out there who needs computer help read less

Where do I start. We have been working closely with Glenn and the team at MicroEd since 2009. In this time MicroEd have consistently shown that they really are IT experts.

The ability of their team to... read moreWhere do I start. We have been working closely with Glenn and the team at MicroEd since 2009. In this time MicroEd have consistently shown that they really are IT experts.

The ability of their team to diagnose and rectify any issues is second to none. We also appreciate their understanding of how important all things IT are to our business (and staff sanity).

We highly recommend MicroEd to any business that wants the best. read less

We have always found all staff at MicroEd to be efficient, knowledgeable and very aware and conscientious of our business needs. Whenever we have had a problem, their response has always been prompt. They have assisted us from all aspects... read moreWe have always found all staff at MicroEd to be efficient, knowledgeable and very aware and conscientious of our business needs. Whenever we have had a problem, their response has always been prompt. They have assisted us from all aspects of our business from website development to our voip phone system all the way through to our security and servers providing access to our 100 staff across multiple sites. We have worked with MicroEd for a many of years and cannot fault them, highly recommend their services to any business, small or large read less